THE ACA REMAINS IN PLACE AFTER BEING STRUCK DOWN BY FEDERAL COURT

December 17, 2018

IRS Expands Preventive Care for HDHPs to Include Chronic Conditions

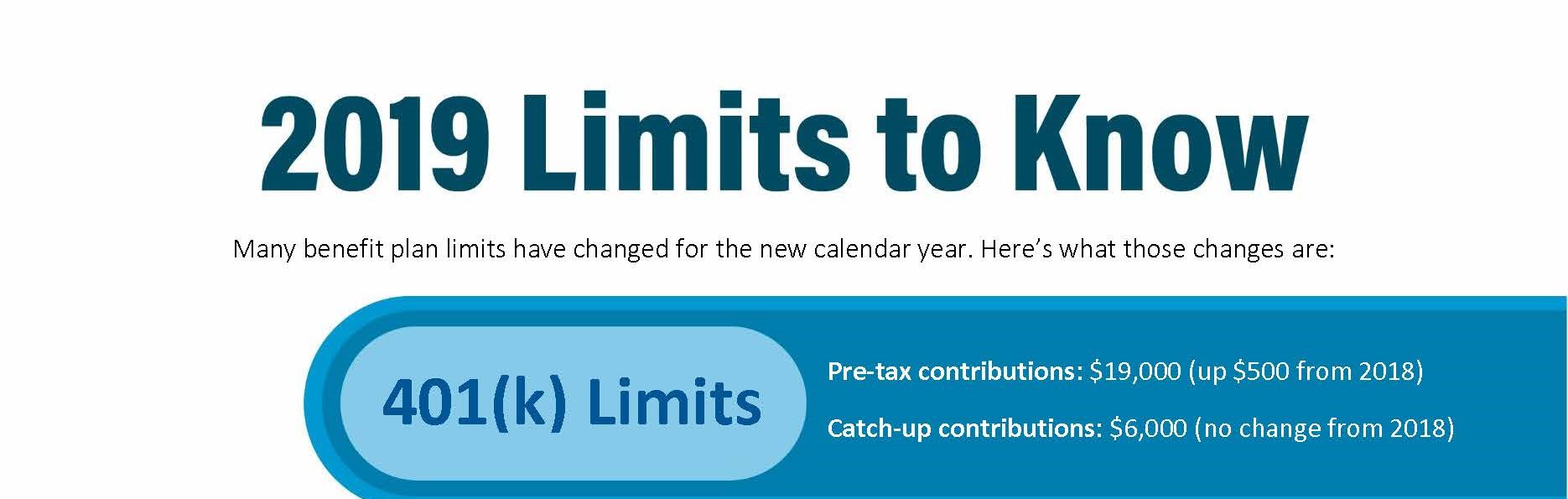

August 7, 2019Many benefit plan limits have changed for the new calendar year. Here are those changes: 2019 Limits to Know Infographic:

401K Limits:

- Pre-Tax Contributions: $19,000 (up $500 from 2018)

- Catch-Up Contributions: $6,000 (no change from 2018)

IRA Limits:

- Contributions: $6,000 (up $500 from 2018)

- Catch-Up Contributions: $1,000 (no change from 2018

Health Savings Account (HSA) Limits:

- Pre-Tax Contributions:

- Single Coverage: $3,500 (up $50 from 2018)

- Family Coverage: $7,000 (up $100 from 2018)

- Catch-Up contributions: $1,000 (no charge from 2018)

High Deductible Health Plans (HDHP) Limits:

- HDHP Minimum Deductible

- Single Coverage: $1,350 (no change from 2018)

- Family Coverage: $2,700 (no change from 2018)

- HDHP Maximum Out of Pocket Costs:

- Single Coverage: $6,750 (up $100 from 2018)

- Family Coverage: $13,500 (up $200 from 2018)

Flexible Spending (FSA) Limits:

- Contributions: $2,700 (up $50 from 2018)

For more information on these limits, please contact us at 775-828-7420 today!